Why are We Still Talking About CX in Financial Services?

Last updated on March 8, 2023

The past few years have witnessed a substantial increase in attention and investment in customer experience (CX) across various industries, including the financial services sector. But some important questions arise: How relevant is CX to modern financial services? How does a company remain committed to providing first-rate customer service in an economic downturn?

Lumoa organized a panel of experts to help answer such questions- and more. The experts included:

- Ekaterina Mamonova – Global Lead, CX and Marketing, Allianz Global Corporate & Specialty

- Sarah Patel – Customer Success Expert (former Finastra)

- Jeremy Payne – Global Operational Lead, FX & Securities, OSTTRA

- Richard Jeffreys – CX Lead, Managing Director, Hartwell Buck

Together, the panel provided insightful viewpoints on CX’s evolution for current needs. Here are the main takeaways.

Why Financial Services Companies Should Focus on CX Now That a Recession is Approaching

According to Ekaterina Mamonova, when a brand makes a promise, and its CX delivers on it well, it produces a positive feedback loop that supports brand integrity and brand values. This does two things: First, it raises the brand’s perceived value in the eyes of the customer, and second, it increases customer loyalty.

She then discussed some core benefits related to delivering CX excellence. These are:

- Differentiating yourself from your competitors – especially across industries where the competition is fierce

- Getting greater customer loyalty and retention

- More effective acquisition of new customers

- A reduction in the cost of serving your existing customers

Mamonova added that one element that is getting more attention is the idea of staff motivation and talent retention. All of these things combined, in general, lead to greater shareholder value.

In the face of an impending recession, many financial services companies are turning to customer experience (CX) to attract and retain customers. And there’s a good reason for that: When you look from the customer’s point of view and balance that with business considerations and shareholder value, you can get less customer churn, more revenue, less risk, and more efficiency.

Instead of immediately deciding, “I want to cut costs with this program” or “I want to make a product that brings in more money,” viewing things through the CX lens forces you to look at all these business aspects. And that’s what makes it strong.

Sarah Patel added that you’ll get the results and rewards you want if you use CX to figure out what will have the most significant impact. “It’s not about giving your customers a box of chocolates or a big hug. It’s mostly about how you can improve their experience in a very practical manner.”

How Can We Still Acquire Funding For CX Initiatives?

It’s always been a challenge to get CX budgets, even more now that we’re entering a recession. The question is, does this make CX an even more compelling investment that needs to be budgeted during times of recession? Or do we need to change our mentality since money is difficult to come by?

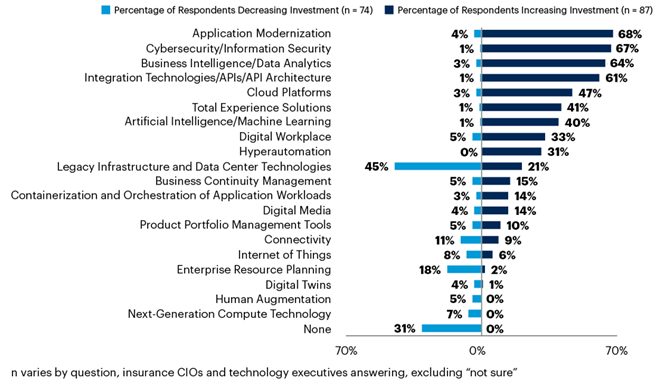

A new Gartner survey found that insurers’ initiatives in 2023 will shift towards improving customer experience and operational excellence instead of growth.

Source: Gartner 2023

While this isn’t surprising, Mamonova believes it’s a truly unique indicator of the value of customer experience initiatives that businesses are witnessing throughout the industry.

She added, “I think the economic stressors of the coming year are also making companies refocus and shift directions to fill gaps that have existed for many years.” From an insurer’s perspective, what is needed is more customer data, including more behavioral and preferential data, shared Mamonova further.

Using such data, we would be able to implement business strategies, including digital ones, upselling and cross-selling strategies, strategies for dynamic customer engagement, and, ideally, plans for revenue development through products and services.

Getting a budget is never an easy task. One needs to start identifying clear objectives and metrics. Before even starting a CX initiative, it is really important to identify the metrics that will be used to measure the success of that program. It can include metrics such as customer satisfaction, loyalty, and retention.

The next step is to focus on tracking and measuring progress against those established metrics. You can use this to determine whether your initiative meets your expectations and has the desired impact.

The last but most critical step is to convey the results. It’s becoming increasingly important to understand business language and metrics. This will enable you to prioritize customer loyalty, and build trust to increase the likelihood of getting recommendations while focusing on customer satisfaction, retention, churn, and customer lifetime value.

How Do You Keep Focused on Supporting and Engaging Customers?

As CX can cover many areas, one might be inclined to ask, where do I begin?

Jeremy Payne shared that your end user is the first thing to focus on. They have to be the starting point of these conversations. Regarding your management information system (MIS), he said that your company should provide data to its support engineers or agents so that when a customer calls, they can help immediately.

The customer support team has an unrivaled view of how clients use your products. Understanding the trends, looking at how agents are being trained, how they use the system, and their internal processes can guide you toward your first step.

The next step is to create improvements that will save both your agents and the company money. In truth, clients need our help regularly, so we need to be proactive and put mechanisms in place to get them the support they need immediately.

For instance, when customers are dealing with credit card fraud, they are understandably anxious and frustrated. Instead of having to phone in and get through an agent, the company could ease their worries by saying, “We’ve just seen something, we’ve stopped it, don’t worry, we’re investigating it, we’ll call you in five minutes.”

Solutions like these can be put in place if you have the correct data to allow you to know what insights are actionable and give you the right results.

To create effective tools for consumers, you must first collect relevant data and conduct insightful analyses. Then, convey this information to product teams, the business, and the technology in meaningful ways related to costs and an understanding of those costs.

Finally, Payne emphasized the need for a customer service representative at every stage, from the first discussion, through deployment and beyond.