How to Measure and Improve Customer Retention

Last updated on September 25, 2024

Customer acquisition has always been a key focus for any business: to make money, you need to get customers. You can also make money by selling to your existing customers, but in order to do that, you need customer retention.

When large numbers of customers are leaving your business, it’s like pouring water into a leaky bucket – you can keep adding more, but at the rate you’re losing, you’re not going to have much left. Still, 44% of businesses focus more of their time and effort on acquiring customers, rather than retaining them.

By focusing at least equally as much effort on retention, you can find and fix the holes in your business. That way, all the work it takes to acquire customers doesn’t go to waste when they drop out after one purchase, and you can continue doing business with your customers for a long time.

Your survival and success depend on repeat customers, especially if you’re a subscription-based business or one whose customers have the potential to repurchase frequently. So, use robust and reliable subscription payment apps, such as the ones explored in a guide on SaaS subscription billing. It’ll help you seamlessly handle your recurring revenue streams and customer relationships. Incidentally, much research has shown how effective and efficient it is to focus on selling to existing customers, rather than trying to acquire new ones:

- It’s 5 to 25 times more expensive to acquire a new customer than it is to retain an existing one.

- A 5% increase in customer retention can increase company revenue by 25-95%.

- Compared to new visitors, existing customers are five times more likely to purchase and four times more likely to make a referral.

It’s clear that focusing on retention has immense benefits. But as the infamous saying goes, “You can’t manage what you can’t measure.” The first step toward focusing on retention is measuring it. Then, you can take steps to improve it.

How to Measure Customer Retention

Customer retention rate

At its root, retention is a function of how many customers stick with you over a given time period. Depending on your business, the time periods that are important to you may be different, but some standards are to measure by month, quarter, and year.

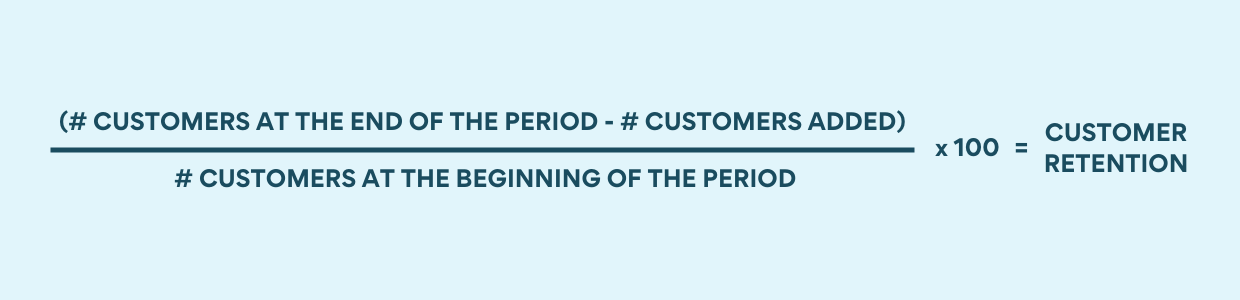

With that in mind, you might be inclined to measure retention simply by taking the number of customers at the end of the month and dividing it by the number of customers you had at the beginning. For example, if you have 1000 customers at the end of the month, and you started the month with 1050, then you might try to calculate retention as follows: 1000 / 1050 = 95%

However, this approach doesn’t account for new customers added over the course of the month, and therefore it can lead to an artificially inflated retention rate. If you use the same example as above but add in the fact that you added 75 customers, then you’ll see a different result. To control for new customers added, you’d subtract them from the total number of customers remaining at the end of the month, like this: (1000 – 75) / 1050 = 88%.

The difference between 95% and 88% is fairly large, and by removing the number of new customers added during the time period, you get a clearer picture of your true customer retention rate.

Gross Revenue retention

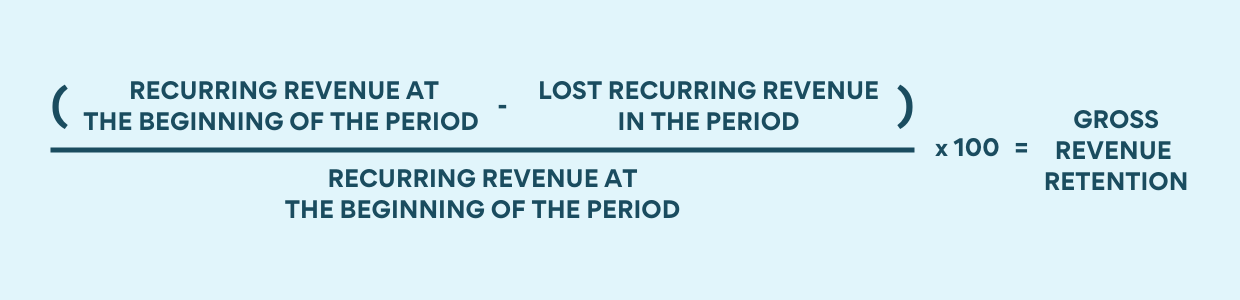

It’s great to know how many customers you’re keeping, but for many businesses, not all customers represent the same amount of value. So losing five customers who make you 100€ a month is a lot different from losing one who makes you 10 000€.

That’s why it’s also helpful to measure revenue retention. Revenue retention is usually measured monthly and annually. To figure out monthly revenue retention, for example, take the amount of recurring revenue you lost in that month, either through downselling or churn, and subtract it from the recurring revenue from the beginning of the month, then divide it by the revenue at the beginning.

For example, you have 100 000€ in recurring revenue at the beginning of the month. During that same month, you lost 5000€ in revenue. (100 000 – 5000) / 100 000 x 100% = 95% gross revenue retention.

Net Revenue Retention

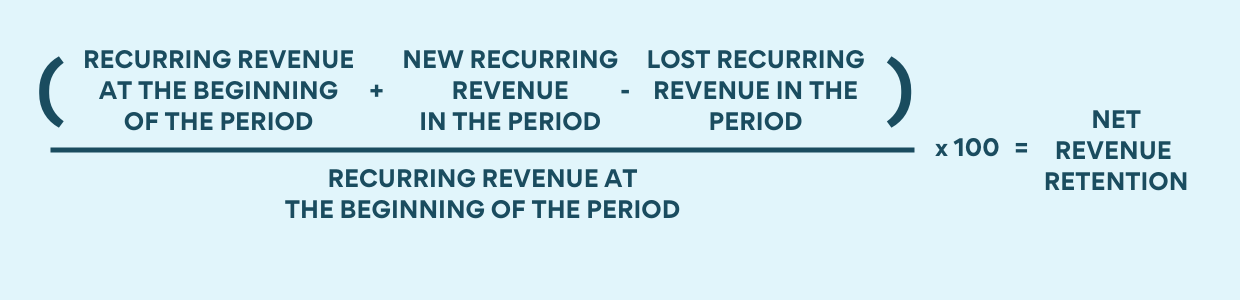

Gross revenue retention is a great metric because it tells you how much revenue you’ve managed to keep in a given time period. However, it doesn’t take into account some of the other benefits of focusing on retention, like reactivated or expansion revenue.

That’s where net revenue retention can be a helpful complement. It’s calculated by taking the starting monthly recurring revenue plus any expansion revenue, then subtracting any lost revenue, divided by the starting revenue.

For example, you started the month with 100 000€ in recurring revenue. Over the course of the month, you added 20 000€ in new recurring revenue and lost 5000€.

((100 000 + 20 000) – 5000) / 100 000 = 115% net revenue retention

Anything over 100% means that you’re growing revenue faster than you’re losing it. So as you focus both on adding new revenue and holding onto existing revenue, you’ll improve this metric.

Churn

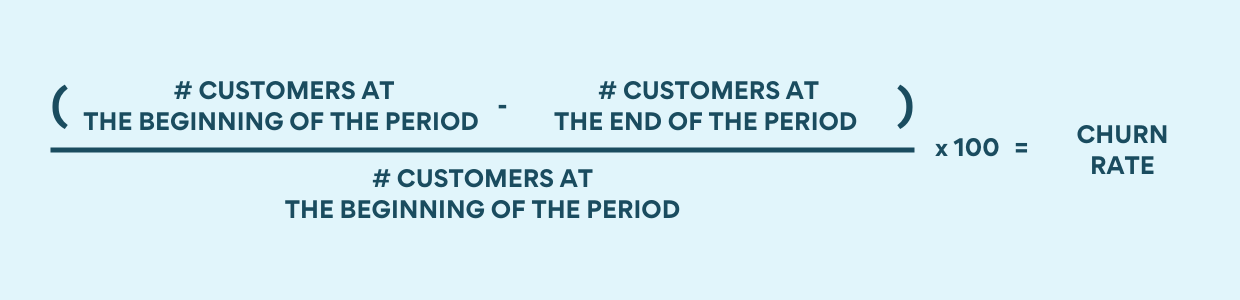

Another way to look at retention is through its inverse metric, called churn. Churn is the portion of customers lost during a given time period, and it can be measured by subtracting the number of customers at the end of the period from the number at the beginning, then dividing by the number at the beginning.

For example, you have 1050 customers at the beginning of the month and 1000 at the end: (1050 – 1000) / 1050 = 5% churn

The revenue retention metrics can also similarly be calculated as gross revenue churn and net revenue churn. Looking at a suite of retention and churn metrics will help you get a balanced perspective.

Benchmarking Retention

Depending on the industry, the average customer retention rate varies. In SaaS, 5-7% annual churn is considered to be reasonable. Industry benchmarks are helpful because they allow you to make some comparisons against others in your field.

But every business is slightly different, and a more realistic way to create goals around retention is to work from your current retention rate and set out to make incremental improvements over time.

Improving Retention

Collect feedback and fix problems

One of the most impactful ways to improve retention is by listening to customers and using their feedback. Sending surveys, like an NPS survey, can provide you with a direct line into what customers are experiencing, illuminating the pain points that customers are facing and giving you an opportunity to make improvements.

As you survey your customers, you’ll notice common themes in their responses. You can then start categorizing all the survey responses based on their theme. This will give you a picture of which issues are biggest. When done manually, this can be a significant amount of work, but a tool like Lumoa makes the process much easier and more scalable.

Once you have an idea of what’s frustrating your customers, then you can work on remediating and eliminating these issues. You’ll also uncover individual cases where you can follow up and correct mistakes immediately. These are golden opportunities to make things right and win customers back.

Another good time to survey customers is when they’re canceling. While it’s best to focus most of your efforts learning about and engaging your customers before they’re ready to head out the door, an exit survey can help you keep a pulse on what’s driving customers away.

Surveys should be sent on an ongoing basis to capture feedback on any changes in your business and to keep driving continuous improvement.

Acquire the right customers

Sometimes, retention problems can point back to the way you’re acquiring customers in the first place. If you’re seeing trends in the types of customers who are canceling related to company size or industry, that might mean that there are segments of customers who simply aren’t the right fit.

It’s important that your sales reps optimize their actions to ensure customer retention. Be sure your sales team is aligned on the ideal customer profile (ie. the people who are going to get the most value from what you offer), and that they are focusing most of their efforts there. Also, make it a point to be upfront about what the product can provide. If the sales team is selling a myth, then customers won’t be around very long once they’re faced with the reality of a product that doesn’t truly meet their needs.

Increase adoption through onboarding

Especially if customers are churning early on in their lifecycle, it may be that they don’t understand how to use your product. Effective onboarding helps teach customers what your product can do and how it can help them reach their goals.

The onboarding process also sets the tone for the relationship. After selling to a customer, if you drop them into your product without any guidance or resources, they’ll likely feel lost and unsupported. On the other hand, providing them with educational materials and being there to assist them shows that you care and are dedicated to their success.

When customers are guided on how to use your product, they’ll be more likely to get value out of it. And when they see value, they’ll be far less likely to leave.

Building trust through transparency

Mistakes happen. Whether that’s data loss, a billing mistake, an outage, or something else, it’s better to be upfront and admit it than to try to sweep it under the rug. Customers will find out anyway, so it’s best to get in front of it and own it.

When you proactively manage your mistakes, you’ll show yourself as a vigilant company that cares about righting its wrongs. And when you work quickly to fix a problem, then provide detail about how you’ll prevent something similar from happening again, you’ll build trust because customers will see that you have integrity even at the worst of times.

One study at Harvard Business School showed that when diners in a restaurant could see the cooks throughout the meal, customer satisfaction increased by 17%. More transparency in restaurant operations ultimately led to more trust and satisfaction.

Keep them coming back

Start by measuring your customer retention, then focus on improving it. By implementing some of the practices above, you’ll see more satisfied customers who stick around longer and your customer acquisition and retention costs will go down. When that happens, your business will grow and thrive, pulling far ahead of those simply focusing on acquisition alone.

To learn more about customer experience-related metrics, check out this article: 6 Most popular customer experience metrics and KPIs explained simply